The recent decline in the average long-term U.S. mortgage rate to below 7% marks a significant development in the housing market, offering a welcome reprieve for potential homebuyers who have been grappling with the challenges posed by soaring borrowing costs and intense competition for a limited inventory of homes.

This shift in mortgage rates is poised to have far-reaching implications for the housing sector, influencing the decisions of both prospective buyers and existing homeowners considering refinancing options.

According to data released by mortgage buyer Freddie Mac, the average rate on a 30-year mortgage has decreased to 6.95% from 7.03% over the past week, representing the lowest level observed since early August.

This downward trend is notably pronounced when compared to the same period last year, when the rate averaged 6.31%.

Similarly, the borrowing costs associated with 15-year fixed-rate mortgages, which are favored by homeowners seeking to refinance their existing home loans, experienced a modest uptick this week, with the average rate climbing to 6.38% from 6.29% in the previous week.

When juxtaposed with the corresponding figures from a year ago, which stood at 5.54%, this increase underscores the evolving landscape of mortgage rates.

Of particular significance is the fact that this latest reduction in mortgage rates represents the seventh consecutive weekly decline.

This sustained pattern of easing rates has been unfolding since late October, when mortgage rates had surged to 7.79%, marking the highest level recorded since the latter part of 2000.

The implications of this prolonged downward trajectory in mortgage rates are multifaceted, with potential ramifications for both the housing market and the broader economy.

For prospective homebuyers, the decreased mortgage rates offer an opportunity to capitalize on improved affordability, potentially empowering a greater number of individuals and families to enter the housing market.

The reduced cost of borrowing may enable aspiring homeowners to expand their purchasing power and consider properties that were previously beyond their financial reach.

Moreover, the prospect of lower monthly mortgage payments could serve as a catalyst for stimulating demand within the housing sector, thereby contributing to increased transaction volumes and potentially buoyant home sales.

Concurrently, existing homeowners may find themselves presented with an opportune moment to explore refinancing options, leveraging the favorable borrowing conditions to potentially secure more advantageous terms for their mortgage.

By refinancing at lower rates, homeowners may be able to lower their monthly payments, reduce the overall interest paid over the life of the loan, or even tap into their home equity for other financial needs.

This could have broader implications for household finances, potentially freeing up discretionary income and bolstering consumer spending.

From a macroeconomic standpoint, the sustained decline in mortgage rates bears implications for the broader economic landscape.

Lower borrowing costs can potentially spur investment in the housing sector, driving construction activity and contributing to employment gains within related industries.

Furthermore, the ripple effects of increased housing market activity may extend to sectors such as retail, as new homeowners invest in furnishing and renovating their properties, thereby stimulating economic activity.

However, it is essential to note that while the reduction in mortgage rates presents an array of potential opportunities, it is not without its caveats.

The broader context of economic conditions, including inflationary pressures, labor market dynamics, and the trajectory of monetary policy, will continue to shape the outlook for mortgage rates and the housing market as a whole.

Moreover, the impact of geopolitical events and unforeseen developments in global financial markets could introduce volatility and uncertainty, influencing the trajectory of borrowing costs in the future.

In conclusion, the recent decline in the average long-term U.S. mortgage rate to below 7% represents a pivotal development with far-reaching implications for the housing market and the broader economy.

By offering improved affordability and potential opportunities for refinancing, the reduced borrowing costs have the capacity to influence the decisions of prospective homebuyers and existing homeowners alike.

As the housing sector responds to these shifting dynamics, it is imperative to closely monitor the evolving landscape of mortgage rates and their impact on housing market dynamics, economic activity, and consumer behavior.

In essence, the current trajectory of mortgage rates underscores the dynamic interplay of economic forces and market conditions, underscoring the need for a nuanced understanding of the factors shaping the housing sector.

As such, stakeholders across the housing industry, financial institutions, and policymakers must remain vigilant in assessing the implications of evolving mortgage rates and their broader ramifications, ensuring a well-informed approach to navigating the evolving landscape of housing finance.

The recent pullback in the 10-year Treasury yield has been echoing a decline, which has been a relief for lenders who use it as a guide to pricing loans.

This yield had surged to its highest level since 2007 in mid-October, but has since been falling, giving hope that inflation has cooled enough for the Federal Reserve to stop raising interest rates.

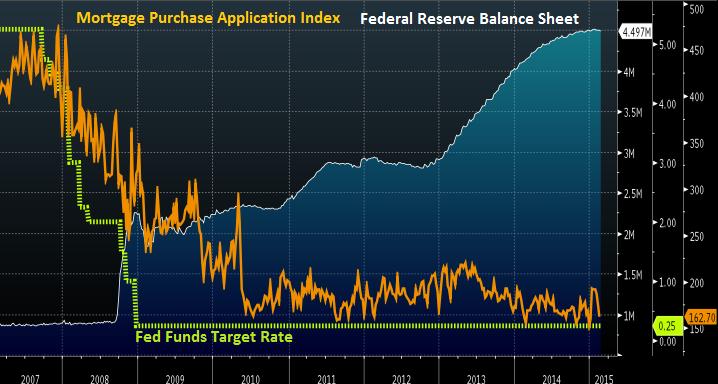

The Fed’s recent announcement of holding its main interest rate steady for the third straight time, along with its officials signaling that they expect to begin cutting rates as early as next summer, has strengthened these hopes.

The expectations for future inflation, global demand for U.S. Treasurys, and the Fed’s actions with its benchmark federal funds rate can all influence rates on home loans.

With inflation continuing to decelerate and the Federal Reserve Board’s current expectations of lowering the federal funds target rate next year, the housing market is likely to see a gradual thawing in the new year. This sentiment has been echoed by Sam Khater, Freddie Mac’s chief economist.

The sharp increase in mortgage rates that began early last year has pushed up borrowing costs on home loans, reducing how much would-be homebuyers can afford, even as home prices have kept climbing due to a stubbornly low supply of properties on the market.

This has weighed on sales of previously occupied U.S. homes, which are down 20.2% through the first 10 months of this year.

However, the recent downward shift in mortgage rates has been a welcome development for homebuyers.

Mortgage applications have notched their sixth consecutive weekly increase, according to the Mortgage Bankers Association.

Despite this positive development, the average rate on a 30-year home loan remains sharply higher than just two years ago, when it was 3.12%.

This large gap between rates now and then is contributing to the low inventory of homes for sale by discouraging homeowners who locked in rock-bottom rates two years ago from selling.

In conclusion, the recent decline in the 10-year Treasury yield has given hope to the housing market, with expectations of a gradual thawing in the new year.

The downward shift in mortgage rates is a welcome development for homebuyers, although the average rate on a 30-year home loan remains high compared to two years ago, contributing to the low inventory of homes for sale.

The future actions of the Federal Reserve and global demand for U.S. Treasurys will continue to influence rates on home loans, and it remains to be seen how these factors will impact the housing market in the coming months.

The recent decline in mortgage rates is indeed a positive development for individuals looking to purchase homes.

The fact that mortgage applications have seen a consistent increase for six consecutive weeks, as reported by the Mortgage Bankers Association, underscores the impact of this trend.

However, it is important to note that despite the decrease, the average rate for a 30-year home loan still stands significantly higher than it did just two years ago, when it was recorded at 3.12%.

This substantial disparity between current rates and those from two years ago is a key factor contributing to the limited inventory of homes available for sale.

Homeowners who secured exceptionally low rates two years ago are now less inclined to sell, given the comparatively higher rates prevailing in the current market.

This situation has implications for the broader housing market. The reduced willingness of homeowners to sell their properties due to the disparity in mortgage rates has contributed to the shortage of available homes for prospective buyers.

As a result, this imbalance between supply and demand has the potential to impact the overall housing market, potentially leading to increased competition among buyers and putting upward pressure on home prices.

In addition to the impact on the housing market, the divergence in mortgage rates over the past two years may also have implications for economic activity.

The housing sector plays a significant role in the economy, with home sales and construction activities contributing to overall economic growth.

The current dynamics in the housing market, influenced by the disparity in mortgage rates, could potentially affect the broader economic landscape.

Furthermore, the divergence in mortgage rates highlights the importance of considering the broader economic context when analyzing housing market trends.

Factors such as inflation, monetary policy, and overall economic conditions can influence mortgage rates, and understanding these broader dynamics is crucial for gaining a comprehensive understanding of the housing market’s trajectory.

In conclusion, while the recent decline in mortgage rates presents an opportunity for homebuyers, it is essential to recognize the broader implications of this trend.

The disparity between current rates and those from two years ago has contributed to a shortage of available homes for sale and may have broader economic implications.

Understanding these dynamics is crucial for stakeholders across the housing market and the broader economy.